Good Car Insurance Australia – We aim to help you make smart financial decisions and our award-winning comparison tools and services are provided free of charge. As a marketplace company, we make money from advertising and this page contains products that have a Go To Site link and/or other paid link where the supplier pays us a fee if you access their site from us or buy a product from them. You do not pay anything extra to use our services.

We are proud of the tools and information we provide and, unlike some other comparison sites, we also include the option to search all products in our database, regardless of whether we have a commercial relationship with the supplier of the product or not.

Good Car Insurance Australia

The ‘Sponsored’, ‘Hot Deals’ and ‘Featured Products’ labels indicate products that sellers have paid to advertise more prominently.

Allianz Comprehensive Review

‘Ranking’ refers to the initial ranking order and is in no way intended to imply that certain products are better than others. You can easily change the order of product types displayed on the page.

Terms, conditions, exclusions, limits and sub-limits may apply to any insurance product displayed on the website. These terms, conditions, exclusions, limits and sub-limits may affect the level of benefits and coverage available under any insurance product displayed on the website. Please refer to the relevant Product Disclosure Statement and Target Market Determination on the provider’s website for more information before making any insurance product decisions. Under 25 and ready to travel? Before you hit the beach or have a late-night snack, we’ll walk you through a car insurance policy that protects you from everything from bumper-to-bumper dreams to big oops.

Whether you’re under 25 and own your own car or use a family vehicle, the starting point in Australia is the same: Compulsory Third Party Insurance (CTP) is a legal requirement for all drivers. If you drive your own car, you need your own CTP policy, which protects you from public liability if you injure someone in an accident. However, you do not need your own CTP policy if you will only be driving the family car. In this case, you just need to convince your parents to add you to their policy as a listed driver. Be aware that this can increase your premium, as younger drivers are statistically at risk for insurance. Because CTP only covers injuries (and not a person’s car or other property), higher levels of insurance are available. This is the next thing we will talk about.

Once the CTP requirements are met, additional insurance options come into play, all of which are optional. As with CTP, if you mostly drive a car your parents own, it can be added to their policy. However, if you own your own car and decide you need this higher level of cover, you will need your own policy.

Open Insurance And Cupra Redefine Car Buying In Australia With New Insurance Integration — Fintech Australia

Other people’s property is basic protection against damage to someone else’s car or property. It doesn’t cover any damage to your ride, but it can save you money if you cause an accident that damages someone else’s vehicle or even your fence.

A step above basic third party title insurance, TPFT covers everything that third party title insurance does, but with less protection for your car. How much does your car cost? You guessed it: fire and theft. This is a good option if you don’t need comprehensive coverage but live in an area that is prone to wildfires or has a high crime rate.

Comprehensive car insurance is a complete package that covers everything that third-party options do, but also protects your own car against accidents, theft, fire, and even random acts of nature like hail storms or fallen trees. If you want to keep your car in top condition or have invested heavily in your wheels, this is the way to go. It is the most expensive option, but offers the widest level of protection.

All things being equal, car insurance for young drivers tends to be higher than average, because young drivers are statistically more likely to cause accidents.

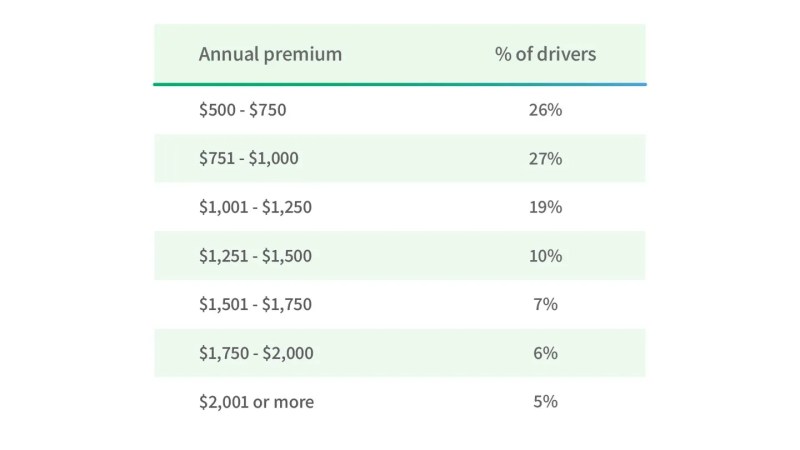

The Cost Of Car Insurance In Australia

However, experience also plays a role. So, for example, if you’re under 25 with a P plate, you’ll find yourself at the top end of the premium scale. Swapping those P-plates for a full license may offer a small reduction in cost, but you should expect to pay more than the average adult.

Of course, that’s not the only thing that matters: the car you drive, where you live, your parking situation and even your gender are taken into account.

So, while we can’t give exact costs, we’ve identified some insurance policies that offer the best value for young drivers. Let’s see:

Every year we hold our Expert’s Choice Awards, where we recognize insurers that consistently offer lower premiums than the competition. For young drivers looking for a cheap policy with a manageable excess, here are our top picks for 2023 premiums:

Ctp Insurance In Nsw: A Guide

It is possible to get paid if you click on products on our website. The rest of the market doesn’t compare. Important information about terms, conditions and sublimation.

We aim to help you make smart financial decisions and our award-winning comparison tools and services are provided free of charge. As a marketplace company, we make money from advertising and this page contains products that have a Go To Site link and/or other paid link where the supplier pays us a fee if you access their site from us or buy a product from them. You do not pay anything extra to use our services.

We pride ourselves on the tools and information we provide and, unlike some other comparison sites, we also include the option to search all products in our database, regardless of whether we have a commercial relationship with the supplier of the product or not.

The ‘Sponsored’, ‘Hot Deals’ and ‘Featured Products’ labels indicate products that sellers have paid to advertise more prominently.

Rental Car Insurance In Australia

‘Ranking’ refers to the initial ranking order and is not intended to imply that some products are better than others. You can easily change the order of product types displayed on the page.

Provide general information about the product. We do not consider your personal objectives, financial situation or needs and do not recommend any particular product to you. You must make your own decision after reading the Product Disclosure Statement (PDS) or preparing documents, or seeking independent advice. You are also advised to check the Target Market Definition (TMD) of the product you are considering. TMD is available on the supplier’s website.

As you can see, it is certainly possible to get cheap car insurance as a young driver; However, it is important to note that other factors such as your age and where you live, or the make and model of your car may affect the cost of your policy.

And it’s not always a matter of price! Sometimes the best car insurance for young drivers isn’t the cheapest option. While price is important, it’s important to consider the amount of value you’re getting from the policy. Finding the right balance is key.

Is Car Insurance Compulsory In Australia?

It’s one thing to compare premiums and another to compare value for money – and that’s the amount of your car insurance coverage and the dollar limit of that coverage. Some car insurance companies offer all or only some of these features as standard on the policy.

So if you’ve narrowed down your search and are stuck with a few options, ask if they follow existing policies.

This is when you break down on the road and need help with your engine. With a more comprehensive policy, you will have to receive roadside assistance and pay extra or do it with a completely different company.

Many policies will cover you for a certain period or dollar amount if you need alternative transportation after an accident or no-fault theft. Others will include car rental after an accident as an optional extra, regardless of whether or not you were responsible for the incident. Check your Product Disclosure Statement (PDS) for details.

Aldi Australia To Offer Car Insurance

It’s not a common feature, but it’s worth asking for. If you have an accident, you can pay an annual fee to keep your premium safe or a no-claims bonus. Check out the fine print on this one.

If your car is only worth $9,000 (according to your insurance company) and you insure it for $20,000, then that is the agreed value. Market value is what the insurance company estimates your car can be sold for when you take out the policy. Not all policies give you a choice between these options, and choosing one over the other can cost you money. Read more about the details of this feature in our guide to car insurance on the agreed value market.

You are usually asked to pay for your annual policy in one lump sum, but some insurers also offer the option of paying in monthly or weekly instalments.