Car Insurance Australia Average Cost – Follow the video below to see how to install our website as a website on your home screen.

As an older driver, you’ve probably seen your car insurance premiums go up over the years. But did you know that the average car insurance premium across Australia is up 18% from last year? According to Canstar’s Steve Mickenbecker.

Car Insurance Australia Average Cost

In fact, Canstar data shows that the average price of car insurance has increased to $274 in 2023 compared to 2022. This is a significant increase, especially for older people on the money has come constantly. But there’s good news: You don’t have to accept these price increases without a fight.

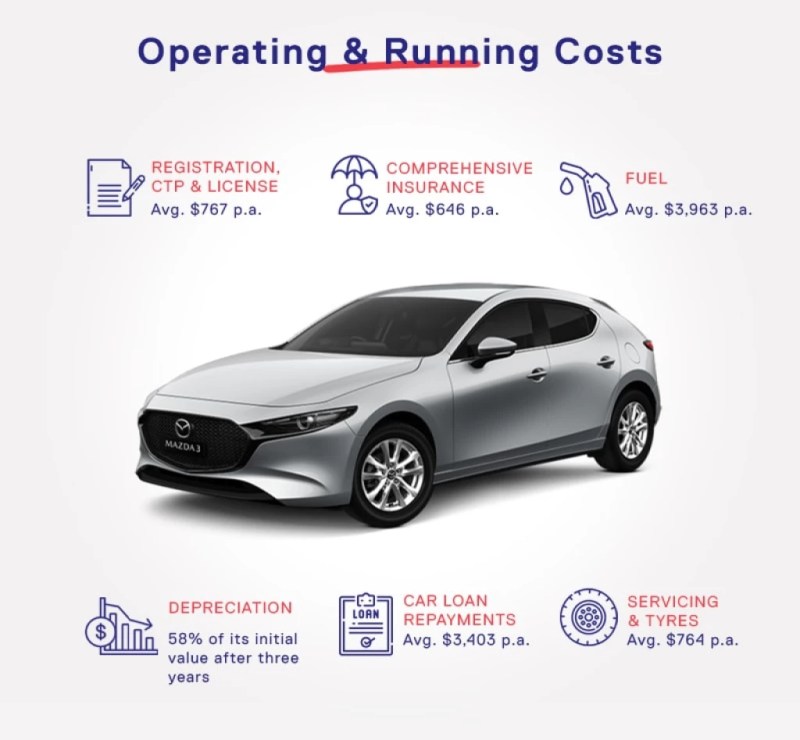

The Rising Costs Of Owning A Car

Access the Comparison Market*, a comparison market that compares 10 different types of car insurance to help you get the best price.

“There are many ways that seniors and seniors can lower their car insurance premiums,” said Adrian Taylor, CEO of General Insurance at Market Compare. “From limiting the age of drivers to changing the way you determine the value of your car (market vs contract value), there are many ways to help you save .”

One of the best strategies, according to Mr Taylor, is to compare insurance policies every year*. “Car insurance premiums almost always go up every year, even if you don’t apply,” he said. “Comparing annual policies can help you find a better price elsewhere.”

Mr. Also agree Taylor didn’t see your update. “It should show both last year’s spending and your new money, which means you can quickly see how much you have to pay,” he said. “Mark the difference to see how much is updated before you compare car insurance.”

Cheap Car Insurance For 20-year-olds

Other tips from Mr Taylor include paying your car insurance every year to avoid extra charges, be aware of who is driving your car (Young drivers can increase your premiums) but don’t wait for your renewal to save money. “You can cancel your existing policies at any time and change insurance companies,” he said. “Just be aware of the cancellation fees that may apply.”

So if you’re tired of seeing your car insurance premiums go up over the years, it’s time to take action. Visit Compare Deals* today and see if you can save by comparing car insurance rates. After all, why pay more when you can pay less?

*Please note members, this is a happy story. All our content has a signature on it which means we can earn money to write an article or advertise a business. We are doing this to help with the running costs of SDC. Thank you

For eligible Australians, the starting price of a private hospital with additional procedures is less than $23 per week (or $3.22 per day) after applying for public health.

Insurance Costs For A Chevy Silverado 1500

For eligible Australians, the cost of combined hospital and additional procedures is less than $24 per week (or $3.39 per day) when there is a public health discount. clan.

Jonathan Lean says: As an older driver, you’ve probably seen your car insurance premiums rise over the years. But did you know that the average car insurance premium across Australia is up 18% from last year? According to Canstar’s Steve Mickenbecker. In fact, Canstar data shows that the average car insurance has increased to $274 in 2023 compared to 2022. This is a significant increase, especially for older people on income come forever. But there’s good news: You don’t have to accept these price increases without a fight. Access the Comparison Market*, a comparison market that compares 10 different types of car insurance to help you get the best price. “There are many ways that seniors and seniors can lower their car insurance premiums,” said Adrian Taylor, CEO of General Insurance at Market Compare. “From limiting the age of drivers to changing the way you determine the value of your car (market vs. negotiated value), there are many ways to help you save. always raise the price every year, even if you don’t ask for it,” he said. “Comparing annual policies can help you find better rates elsewhere.” It should show both last year’s expenses and your new expenses, which means you can see how quickly you have to pay,” he said. “Mark the difference to see how much updates before you compare car insurance. Other advice from Mr Taylor includes paying your car insurance every year to avoid extra costs which is to consider who drives your car (younger drivers will increase the price. the price you pay ) and don’t wait for your renewal to save money. “You can cancel your existing policies at any time and change insurance companies,” he said. “Just be aware of the cancellation fees that may apply.” So if you’re tired of looking at your car insurance every year, it’s time to take action. Visit Compare Deals* today and see if you can save by comparing car insurance rates. After all, why pay more when you can pay less? *Please note members, this is a happy story. All our content has a signature on it which means we can earn money to write an article or advertise a business. We only do this to help with the running costs of SDC. Thank you Click to expand… Thank you for this story. SDC. Every year the market should be compared. I can speak for myself in this, I have a hard time doing this for all the insurance every year these days. What happened to

Anything and everything Money Grab knows how much they can rob everyone and maybe most of us.

Lie to me, I have been with the same company for years (I think being a better customer is a good thing). Never gone away, justice is another name for a gun)

When Does Car Insurance Go Down? (2024)

Jonathan Lean says: As an older driver, you’ve probably seen your car insurance premiums rise over the years. But did you know that the average car insurance premium across Australia is up 18% from last year? According to Canstar’s Steve Mickenbecker. In fact, Canstar data shows that the average price of car insurance has increased to $274 in 2023 compared to 2022. This is a significant increase, especially for older people on the money has come constantly. But there’s good news: You don’t have to accept these price increases without a fight. Access the Comparison Market*, a comparison market that compares 10 different types of car insurance to help you get the best price. “There are many ways that seniors and seniors can lower their car insurance premiums,” said Adrian Taylor, CEO of General Insurance at Market Compare. “From limiting the age of drivers to changing the way you calculate the value of your car (market vs. negotiated value), there are many ways to help you save. percent increase compared to 2022. One of the best strategies, according to Mr. Taylor, the annual insurance comparison * every year, even if you didn’t ask for it,” he said comparing annual policies can help you find a better price elsewhere.” “It should show last year’s spending and your new spending, which means you can quickly see how you have to pay,” he said. “Mark the difference to see how much the update is before you compare car insurance.” Other tips from Mr Taylor include paying your insurance car every year to avoid additional costs by thinking about who drives your car (young drivers will increase the price you pay) and don’t wait for your renewal to save money. “You can cancel your existing policies at any time and change insurance companies,” he said. “Just be aware of the cancellation fees that may apply.” So, if you have an illness that sees your medical bills start to rise year after year, it’s time to take action. Visit Compare Deals* today and see if you can save by comparing car insurance rates. After all, why pay more when you can pay less? *Please note members, this is a happy story. Everything in