Fintech Jakarta – The financial world has undergone significant changes over the past decade, with technological innovations and digitization revolutionizing the way financial services are delivered. In particular, the adoption of Islamic fintech services has increased in the DKI Jakarta and West Java regions, indicating an important trend in the Islamic finance industry. These services include digital financial solutions that comply with Islamic laws and principles, traditional Islamic banking with modern financial technologies such as digital payments, insurance technology, robo-advisors, peer-to-peer (P2P) lending, and crowdfunding platforms.

By providing affordable, efficient, easily accessible and Shariah-compliant financial services, Islamic fintech has far-reaching socio-economic implications, especially in regions with significant Muslim populations such as Indonesia. In an important study by Sethi Rabia Mogfiroh and Wardat Al Jannah, using the Technology Acceptance Model (TAM), we gain valuable insight into this rapid phenomenon.

Fintech Jakarta

This study examines the adoption and use of Islamic fintech services among user cooperatives in DKI Jakarta and West Java. The researchers sampled cooperative users from these areas using an online questionnaire and non-probability random sampling technique. The questionnaire included basic information and a survey about FinTech services. Structural equation modeling was used to analyze data and test hypotheses, focusing on perceived usefulness (PU), perceived ease of use (PEU), trust (TRU), behavioral intention (BI), perceived risk (PR), variables. Government. Support (GS) and User Innovation (UI). The results highlight the following observations:

Indonesia’s Investment Mainstays Remain Fintech And E-commerce

Perceived usefulness (PU) and perceived ease of use (PEU) emerge as key determinants of user acceptance. Previous studies have consistently shown that these characteristics contribute significantly to the adoption of new technologies, and this study confirms these findings. More than 60% of respondents confirmed that Islamic fintech services offer significant benefits, and more than 70% found the services remarkably easy to use.

Trust (TRU) and perceived risk (PR) affect Islamic fintech applications. Users’ confidence in the compliance of these services with Sharia principles significantly influences their acceptance. Encouragingly, 67% of respondents expressed confidence in Islamic fintech services, while 75% felt less risk in using these services. A significant reduction in risk is a clear driver of high adoption rates.

Behavioral intention (BI) and government support (GS) drive adoption rates. The data shows that 78% of respondents have a positive intention to use Islamic fintech services in the future. Furthermore, a significant 83% believe that government support plays an important role in the development of the Islamic fintech industry. The research highlights the importance of strong government support and positive user intent to increase adoption.

An intuitive and easy-to-use user interface (UI) is emerging as an important factor for adoption. An effective user interface can improve both ease of use and perceived usefulness. Encouragingly, 80% of respondents emphasized the importance of a simple, easy-to-navigate interface in influencing their decision to adopt these services.

Indonesia: Future Fintech Giant?

Rabia and Warda’s study highlights the effectiveness of TAM in analyzing the implementation of Sharia fintech services in cooperatives. This is consistent with previous research that emphasizes the importance of PU, PEU, TRU, and BI in adopting FinTech services. However, it presents new perspectives by emphasizing the importance of public relations and its influence on the adoption of FinTech services. These insights provide valuable guidance to cooperatives and FinTech service providers in developing marketing strategies to promote the adoption of Sharia FinTech services.

However, Islamic fintech faces many challenges to unlock its full potential. Sharia compliance, regulation, cyber security and bridging the digital divide are critical to ensure its widespread adoption and role as a major contributor to Indonesia’s economy. Furthermore, the study revealed a lack of knowledge about Sharia fintech in Indonesia, with only a few cooperatives adopting fintech services. However, Indonesia, which has the world’s largest Muslim population, has great potential for the development of Sharia fintech services. Some notable examples of Sharia fintech services located in Indonesia include Association of New Indonesian Cooperatives (ANKI), ALAMI Sharia, Ashish Siddiqui Jakarta Digital Cooperative, Sahab Saria, Amina Fintech, Katbisa and others.

To better understand the opportunities and challenges of Islamic fintech, let’s look at the actions of the main players in Indonesia: Asociasi Koperasi Neo Indonesia (ANKI), Sahab Surya and Amana Fintech. ANKI’s digitization efforts aim to modernize the cooperative landscape and promote financial inclusion, though they must also address the digital literacy gap. Sahab Sirah, a lending platform, is seeing success but faces regulatory hurdles that limit its growth. Amana Fintech offers many digital services but faces data security issues. These platforms can build trust and expand their user base by effectively addressing these challenges and taking advantage of the opportunities.

With significant growth in the turnover of cooperatives and active cooperatives, Islamic fintech services have the potential to make a significant contribution to the Indonesian economy. In addition, these services can empower individuals and small businesses by mobilizing resources and providing access to financial services that were previously out of reach, promoting business growth. However, the industry must overcome challenges such as ensuring Sharia compliance, addressing cyber security concerns and bridging the digital divide to strengthen trust and play a significant role in the country’s economy.

Indonesian Fintech Investments Halved In 2023: Study

As Indonesia’s financial landscape evolves, Islamic fintech is a powerful force for change. Its success lies in addressing the complexities of Sharia compliance, creating a supportive regulatory environment, strengthening cyber security measures and ensuring equal access to digital services. Sharia fintech literacy and development is essential to bridge the gap between potential users and these innovative services.

With a growing Muslim population and growing demand for digital financial solutions, Indonesia is positioning itself to become a global leader in Sharia financial technology. The examples of ANKI, Sahab Sirah and Amana Fintech highlight the opportunities and challenges of this changing industry. Through persistence, innovation and collaboration, these platforms can shape the future of finance and improve the country’s socio-economic well-being.

Finally, DKI is a dynamic journey of adoption of Sharia fintech services among cooperative users in Jakarta and West Java that offers great promise. By addressing the complexities of trust, user interface, government support and perceived value, Islamic fintech can truly flourish in Indonesia and ultimately contribute significantly to the country’s economic growth and financial inclusion. The company and Boston Consulting Group (BCG) have jointly published the most comprehensive reports ever on Indonesia’s fast-growing fintech sector.

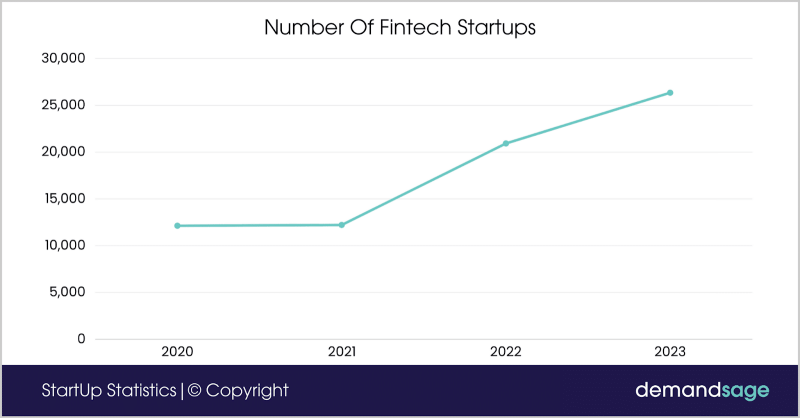

The report is titled “Indonesia’s fintech industry is poised for growth” and charts the growth of fintech in the country in several sub-spaces from fintech startups in 2011 and the rise of the local digital economy to 2022. Unlocks the current tech ecosystem as a key driver of payments, debt and wealth.

Saatnya Manfaatkan Fintech P2p Lending Untuk Pengembangan Usaha

The number increased from 51 in 2011 to 334 in 2022. Initially, growth was mainly driven by the payments segment. However, Indonesia’s fintech landscape is now diverse and dynamic, and lending, payments and property are becoming bright industries of the future. In addition, new players are emerging in areas such as software as a service (SaaS) and insurance activities, indicating that fintech in Indonesia is growing and moving towards more complex products and services.

CAGR of 20%+ till 2025. In the area of loans, more than 30 million were active

Period 2017 to 2019. Growth and monetization is the main focus of the D+ financing series.

Pre-Series D. Over 80% of fintech deals from 2020 to 2022 were for Pre-Series C

Tech In Asia Events

“I am happy to say that we are the most active investor in Indonesia’s growing fintech industry, which offers huge growth potential. This is indicated by the significant increase in the number of fintech players, the growth of customers and the increase in equity financing. We continue to support and invest in the growing regional fintech sector. Area potential for placement.

“As our comprehensive analysis shows, the fintech scene in Indonesia is growing, indicating huge growth potential for the country’s digital economy. Led by customer needs, led by fintech collaboration between players and traditional financial institutions, regulatory bodies, it is an exciting time for innovation. and regulatory Perspective We hope that our insights will provide industry players with a deeper understanding of the fintech ecosystem, putting them in a stronger position to seize new opportunities and gain a competitive advantage.

Ed. The company’s mission is to empower entrepreneurs with more than just capital by combining operational experience, industry knowledge, deep local networks and resources. The ACV team has invested in over 120 technology companies in the sector since 2012.

Boston Consulting Group, one of the world’s leading consulting firms, has partnered with business and community leaders to solve their most pressing challenges and realize their greatest opportunities since its founding in 1963.