Car Insurance Brokers Uk – Car, Home & Travel Insurance Certis Insurance – Specializing in bespoke cover for car, travel, property and jewelery for darts players.

We all know that insurance can be a minefield, so we teamed up with Graham and Adam at Certis Insurance, who will provide you with the right information, professional service and the right coverage for your needs, and they will do all the work. for you

Car Insurance Brokers Uk

We have support for any issue, problem or dispute you may have, we make no assumptions, but protect you as a member.

Broker Highway Car Insurance Offers Flexible Cover For A Range Of Risks.

Please make an offer to members: If you are unsure, we can always do this for you, email us at [email protected] or contact your representative.

As a professional athlete, you may be aware that if you do not disclose to your current insurance company that you are a professional athlete, you may not be able to file a claim. So you need to talk to the right people to get the right coverage and the car insurance you want.

Below are some examples of false or misleading statements frequently found in insurance proposals for people in the sports and entertainment industry. The slightest misinterpretation made by the insurance company can result in the policy being canceled and/or the claim being rejected.

It is important to note that each proposal form will ask if any proposer or driver has ‘ever canceled or refused insurance’. If the worst happens and your policy is canceled or no longer valid, you may have difficulty getting insurance in the future, so it’s important to always make full and clear disclosures. Everyone needs car insurance to hit the road. However, having an expert can make a big difference in how much you save on premiums when comparing insurance quotes and policies.

Motor Fleet Insurance Brokers

Luckily, insurance is always easy. As specialist insurance brokers, we compare policies and quotes to find the best policy at the right price for you. With our expertise and experience, we will guide you every step of the way to find the right coverage and the lowest premiums.

If you want to find out about classic car insurance, specialist insurance for convicted drivers or alternatives to your policy, you can always chat with us on 0800 107 0912.

If you want to drive your car from A to B, you need insurance as it is a legal obligation.

The minimum coverage required by law applies only to third parties. We always recommend that drivers consider a higher level of coverage for extra financial protection in the event of an accident or someone tries to steal their car.

Arkwright Insurance Brokers

It really depends on your financial situation. As a general rule, paying a lump sum for your car insurance is cheaper than a monthly direct debit as insurance companies usually offer discounts.

If you pay for annual coverage in monthly installments, you may incur additional fees or interest. Because insurance companies buy policies to reimburse you.

However, not everyone can afford their insurance all at once, so we understand that for many people, it is easier to spread the cost of insurance over the year.

We are happy to give you all the advice you need to make the right choice, to find the most cost-effective payment option for you. Call us on 0800 107 0912 and we’ll guide you through your car insurance journey.

Lynch Insurance Brokers

The above list is not a complete list of all coverage available under the same policy. This is a guide to what is covered depending on the policy, insurance company and your circumstances.

Our team is trained and authorized to provide consulting services to help ensure that a policy meets your needs. We take the time to understand your specific needs and explain in detail the coverage available through your policy and insurance company – including applicable limitations and exclusions.

Classic Car Insurance Find out more about policies for older cars over 20 years and under 40 years here. Get classic car insurance

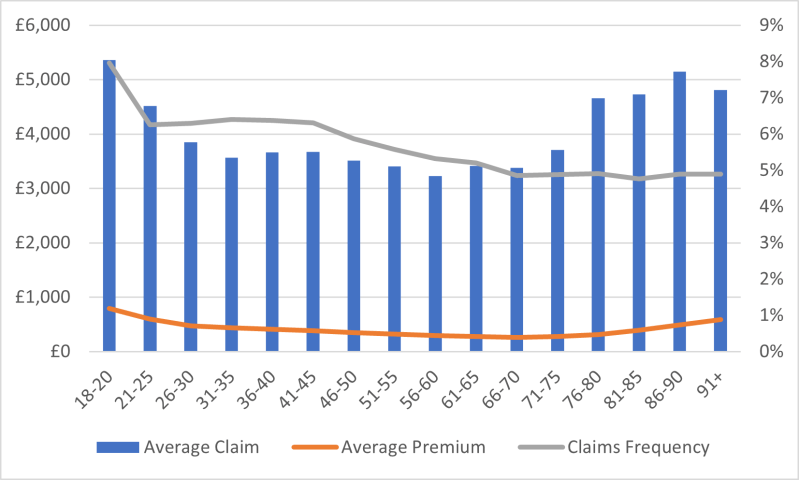

Car insurance for elderly drivers Insurance for those aged 50, 60 years and above. Find out how age affects your premiums here. Get car insurance for adult drivers

Drive Away Insurance

Conviction Car Insurance It may be difficult to get insurance after an auto conviction. Find out how we can help here. Get Penalized Car Insurance

*Take out an insurance policy, or renew an insurance policy, if you find a cheaper offer within 48 hours, you can provide written proof, we will cancel your insurance policy. Issue a full refund. Subject to terms and conditions.

*51% of consumers could save £529.95 on their car insurance. Profits are calculated by comparing the lowest price found with the average of the next five cheapest prices quoted by insurers on insurance comparison site Seopa Ltd. This is based on representative cost savings from February 2024. The savings you may obtain depend on your personal circumstances and how you choose your current insurance provider.

**These prices reflect the cheapest policies we are selling this year (2024) and may not represent the price you are quoted for your insurance policy and/or your risk level based on ideal risk conditions. *51% of consumers could save £490.26 on their car insurance. Savings are calculated by comparing the lowest price found with the average of the next four cheapest prices quoted by insurers on insurance comparison site Seopa Ltd. This is based on representative cost savings from June 2023 onwards. The savings you can obtain depend on your personal circumstances and how you choose your current insurance provider.

Provenance Insurance Brokers (@provenanceinsu1) / X

Insurance companies classify cars into one to 50 groups based on risk factors. Generally, Group 1 cars are the cheapest to insure, while Group 50 cars are often the most expensive.

A car’s class is determined by price, performance, safety features, and estimated maintenance costs. When calculating your car insurance premium, your car insurance group will factor into your premium along with other factors such as zip code and driving experience.

The statutory excess is a fixed minimum amount that must be paid towards the cost of any claim you make. This amount is set by your insurance company and is non-negotiable, however the mandatory excess amount varies for different policies. When choosing an excess option, it is important to consider your financial situation and ability to pay the excess in the event of a claim. Our team will be happy to walk you through the policies to find one that fits your budget and needs.

For example, if your policy has a statutory excess of £500 and you make a claim for £2,000, you will pay the first £500 in claim costs and we will cover the remaining £1,500.

Car Insurance Online Uk

Voluntary excess is an additional amount you can choose to add on top of the mandatory excess. This will help reduce your premium costs because you agree to pay a higher amount for each claim.

For example, if your policy has a statutory excess of £500 and you decide to add a voluntary excess of £250, you will pay the first £750 towards the cost of any claim and we will cover the rest.

A no claims discount is a discount you can get on your insurance premium if no claims are made on your policy within a certain time period.

The deductible increases each year because you don’t claim up to the maximum amount. These rewards for safe and responsible driving will help reduce your insurance costs over time, so it’s important that you tell us about your claim discount history when we calculate your estimated quote.

Motor Fleet Insurance

You must notify your insurance company within 24 hours to ensure your claim is processed quickly and any necessary repairs or maintenance can be arranged.

Delays in reporting an accident could result in complications in your claim or denial of coverage, so it’s best to report it as soon as possible.

You can file a claim on your car insurance immediately after a car accident as long as it is reported to your insurance company. However, the exact time period to file a claim may vary depending on the terms of your policy.

It’s a good idea to check your policy documents to ensure the correct timeframe for making a claim. If you need help filing a claim after an accident, our dedicated claims team is available by phone 24/7, 365 days a year. To find out the claim number associated with your type of insurance, visit our claims page.

Digital Marketing Experts For Insurance Brokers

When applying for car insurance, you must declare any medical conditions that may affect your ability to drive safely.

This could be