- Car Insurance Type Malaysia

- Conventional Car Insurance Vs Motor Takaful

- Car Insurance Loss Of Use

- Cheap Car Rental Rare Honda Civic Turbo Unit For Rent! P Plate Malaysia Welcome! No Deposit!, Cars, Car Rental On Carousell

- Types Of Car Insurance Policies In Malaysia

- Malaysia Motor Insurance

- Cimb Secure Motor Insurance

Car Insurance Type Malaysia – Looking to buy car insurance? Before you buy one, it’s best to first understand the different types of car insurance. This should ensure that you get the right coverage.

To begin with, there are three types of car insurance policies in Malaysia. Let’s take a look at each type of policy and what it covers.

Car Insurance Type Malaysia

The first is comprehensive insurance, also known as first party insurance.This policy provides more comprehensive coverage to policyholders.

Conventional Car Insurance Vs Motor Takaful

Comprehensive motor insurance protects policyholders’ vehicles in the event of accidents, fire and theft.This policy provides third party cover.

Comprehensive insurance is usually required for new cars over 10 years old. For cars over 15 years old, most insurance companies will recommend Third Party, Fire and Theft (TPFT) cover, which we’ll cover next.

Third party, fire and theft insurance protects against third party loss and damage where you are at fault.

This type of insurance is usually cheaper than comprehensive insurance and is more suitable for older and rarely used vehicles.

Car Insurance Loss Of Use

Third party insurance is the most basic policy.In Malaysia, motor vehicle owners must have third party insurance as a minimum to legally drive on Malaysian public roads.

A “third party” in this policy is someone who is involved in an accident with your vehicle that is your fault.

This policy only covers third parties for loss or damage caused by your vehicle to third parties and their property.

This policy provides very limited coverage as it can only be used for third party claims.If any damage is done to your vehicle, you will have to bear the cost of repairs.

Generali Car Insurance

For your easy reference, below is a summary of the differences between the three types of vehicle insurance policies:

To help you choose the right type of car insurance policy, below are three key aspects to consider.

It is important to choose the right insurance based on the age of your car.This is to avoid over insuring (over insuring your car).

For example, if your car is more than 15 years old, you can buy third party, fire and theft insurance.

Choose Value & Assurance With Honda Insurance Plus (hip)

On the other hand, if your car is new, comprehensive insurance is recommended as it can provide complete coverage for your vehicle.

If you use your car frequently, you are advised to purchase comprehensive car insurance as it can provide more coverage.

For example, for cars older than 10 years that are used frequently, comprehensive insurance is a good option because the policy includes coverage in the event of a car accident.

For vehicles older than 10 years but with a market value of more than RM10,000, you are encouraged to get comprehensive coverage to ensure your vehicle is adequately covered crash.

Cheap Car Rental Rare Honda Civic Turbo Unit For Rent! P Plate Malaysia Welcome! No Deposit!, Cars, Car Rental On Carousell

Most insurance companies offer the three types of insurance policies we’ve covered above.Before purchasing a policy, consider the policy coverage, the age of your vehicle, the use of the vehicle, and the amount of coverage to ensure adequate protection.

Use where you can get 15 free car insurance quotes to help you compare policies offered by different insurers in Malaysia. Compare quotes and easily renew your car insurance completely online.

One of the largest insurance comparison sites in Malaysia offering over 10 brands of policies Get your free insurance quote today Here’s what you need to know to find the best insurance for your car: We help you understand the types of cover, terms like NCD and excess, how they affect your premium and more.

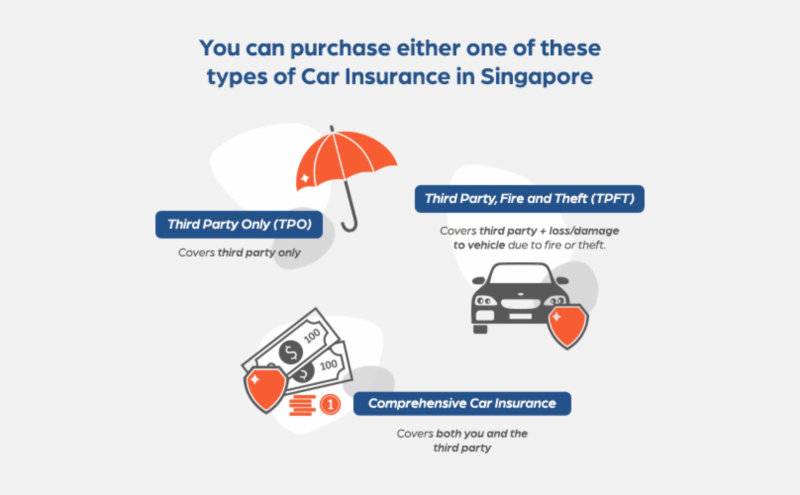

Owning a car in your name in Singapore is a legal requirement to have car insurance There are 3 types of car insurance plans you can choose from: Third Party Only, Third Party, Fire & Theft and Comprehensive Car Insurance.

Malaysian Motor Detariffication

TPO offers the most basic insurance cover and is the least required in Singapore.It only covers third party and/or liability.

TPFT provides additional coverage over and above the basics included in TPO.Any loss or damage to your vehicle due to fire and theft will be covered by TPFT.

Comprehensive car insurance is a universal plan that covers you, your car, your passengers and your liabilities in both minor and major accidents.

These are the three car insurance terms that every driver should know.Depending on how you customize your policy, they can significantly affect your annual premium.

Types Of Car Insurance Policies In Malaysia

When you choose your car insurance coverage, you pay extra out of pocket for damages before the insurer covers the rest.You can adjust the extra payments.

Adam is communicating with PIE on his way to work when a tree suddenly falls in his path. He crashes it and it costs $2,000 to fix. Fortunately, his extra cost is $500. So he only pays $500 and the insurer gets the rest.

1. Exceeding “Own loss”. this excess only applies to your vehicle, it does not cover third party damage.

2. “Third Party” surplus. this excess applies to damages caused by third parties You may have to pay this to your ‘own loss’ excess.

Best Car Insurance In Malaysia 2024

3. “All claims” premium. this excess refers to the total amount payable per accident, regardless of whose loss the excess covers.

Generally, a higher choice helps reduce car insurance premiums.However, with lower premiums, you expose yourself to a higher financial risk down the road.

This discount encourages drivers to drive safely You get 10% discount every year up to 50% without claim.

NCDs are not at risk for claims if the driver’s liability does not exceed 20% under the Barometer of Liability Agreement (BOLA). If so, their NCDs may be reduced by 10% or more.

Malaysia Motor Insurance

Some drivers pay extra for NCD protection schemes, this allows them to make a claim and still retain their NCD benefits.

Your NCDO can also be transferred from one car to another. Even if your car is scrapped, you can keep your NCD for at least 12 months. On another note, if you have two cars, your second car cannot use the same NCD of advantages than the first car.

Named drivers are recognized by insurers to drive vehicles.They are covered by the primary employer’s insurance policy and are entitled to the same benefits/protections.

Family members are often included as named drivers to reduce financial risk.If an unknown driver is involved in an accident while using your vehicle, the insurer may add more to your claim.

Cimb Secure Motor Insurance

Insurance premiums vary from driver to driver. Generally, the more serious the accident, the higher your car insurance premium.

1. Make and model of car – European make cars have higher import taxes and stock prices which add to the premium cost.

2. Age of the car – Car insurance costs generally decrease with the age of your car

3. Insurable age – People under 30 and over 65 can expect higher premiums.

Insurance & Road Tax Renewal 更新车险与路税服务

4. Occupation – outdoor work indicates that you will use your car a lot and create a high risk of accidents.This can translate into higher premiums

5. Family Status – Insurers may lower your car premium if you have a family to care for

6. Driving Years – Drivers with less than four years of experience will pay higher auto insurance

7. Type of car used – Private hire insurance premiums are higher than private car policies

Insurance Plans For Your Overall Protection

8. History of Driving Accident Claims – A “Loading Fee” applies if you file a claim over $10,000 or if you file two or more claims in the past three years.

9. No claim discount – If you’ve been claim free for a number of years, you’ll be rewarded with a renewal discount.Learn more about NOCs here.

10. Honesty and integrity – Being dishonest about your driving history and providing incorrect information can cost you higher premiums.

11. Modification of Vehicle – Modifications that do not comply with LTA will require additional coverage which will increase the premium price.

5 Best Private Car Services From Sg To Tioman Island (2024)

• Submit police reports on accidents, non-Singapore registered vehicles and collisions with government property

Here are some common mistakes you make when filing a car insurance claim. Avoid them to process your claim faster and get your payment on time.

1. Failure to file a proper claim within 24 hours – Generally, accidents must be reported within 24 hours and claims must be filed as soon as possible. Otherwise, your claim may be denied. You may need to send your vehicle to an expert check