Car Insurance High Uk – Useful Links Terms and Conditions Privacy Policy Information Security Cookies Terms of Use Press Kit Work with us Download the App

Our analysis of 2.5 million car insurance quotes by MoneySuperMarket found that 19 million low-mileage motorists in the UK – people who drive less than the UK average of 7,134 miles per year – are at risk of being overcharged for their car insurance.

Car Insurance High Uk

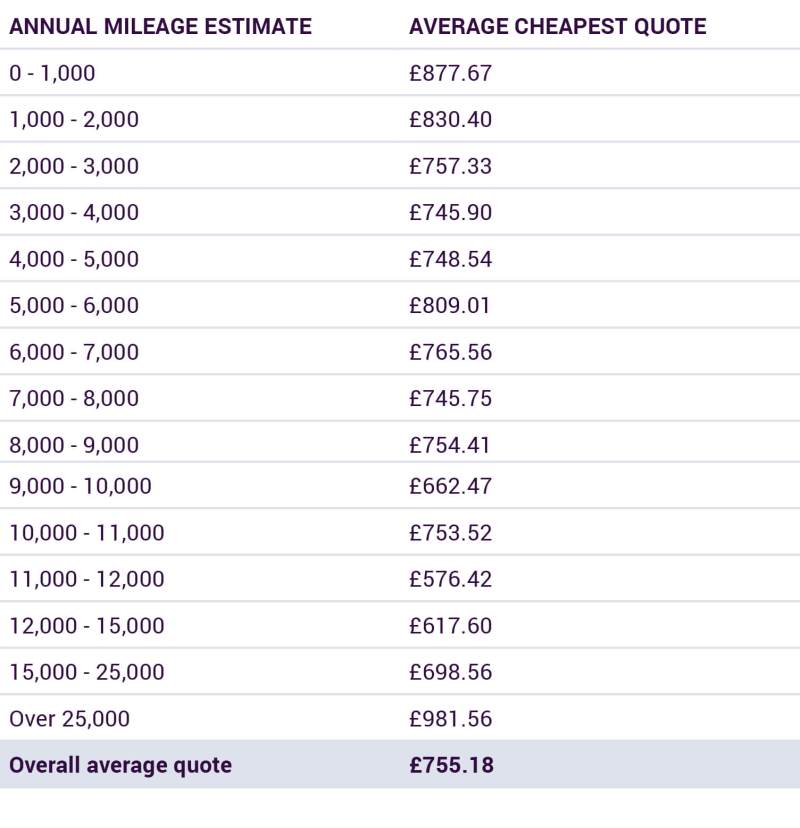

On average, motorists who drive 5,000 to 6,000 miles a year will pay an average of £233 more than those who drive 11,000 miles a year.

What Is Business Car Insurance?

Car insurance is a very simple concept. You pay an annual premium to your insurance company to protect you in the event of the worst. The price you pay for insurance depends on how much your insurance company thinks you will claim. The lower the risk you take (for example, because of a longer driving history), the lower your premiums will be. exactly like that.

Your insurance company will consider a number of factors to determine your risk level, one of which is the amount of time you will spend on the road. It stands to reason that if you park your car instead of driving, you are much less likely to get into an accident. So car insurance should be cheaper for low mileage drivers, right? False Unfortunately, there is evidence that premiums paid by low-mileage drivers are used to subsidize the insurance costs of high-mileage drivers. This is not fair.

We’ve analyzed nearly 2.5 million car insurance quotes on the MoneySuperMarket comparison site. We found that low-mileage drivers – motorists who say they drive less than the national average – could actually be paying as much as £389

According to the latest figures released by the Department for Transport, UK cars drive an average of 7,134 miles a year, meaning (by our calculations) more than 19 million drivers are at risk of being overcharged. Their car insurance.

How To Get Cheap Car Insurance

That is why in 2018 we launched a policy of paying by post. We think it’s time for a smarter, better type of car insurance for low-mileage drivers. This is now possible because, unlike many traditional insurance providers, we can accurately measure the mileage of our members. We believe that if you drive less, you should actually pay less. It’s really simple.

“Our mission is to help drivers find the best deals on car insurance, so offering paid mileage coverage is a no-brainer. We love putting the brakes on low-mileage drivers. If you drive less, you should pay less.”

“It’s always important to shop around to make sure you’re getting the best deal on car insurance. Now that includes looking for new technology that offers drivers flexible car insurance. How

For a long time, drivers believed that the price they paid for car insurance was tied to the number of kilometers they drove – the less they drove, the less they paid.

Is Insurance Higher On Red Cars?

This analysis shows the opposite, with cheap car insurance quotes for motorists who drive 11,000 to 12,000 miles per year.

Even the most experienced drivers are charged exorbitant rates, with drivers aged 50 to 64 who drive 5,000 miles a year paying £100 more than those who drive 11,000 to 12,000 miles.

Motorists with a 6-8 year claim-free discount and driving between 5,000 and 6,000 miles will still pay £100 more than those driving 10,000 to 11,000 miles a year.

“The argument is that less experienced drivers should be charged more, but if someone has been driving for 20 years, whether they do 3,000 miles a year now or 10,000 miles a year, it will have little effect on their driving skills. No claims.” discount Shows experience, but drivers with low mileage are still penalized.

Uk Car Insurance Costs Bave Risen By 22% Since 2022, Faster Than France And Germany. The Government Are Creating A Task Force To Investigate Why But Some Of The Reasons Are Pretty Obvious.

Drivers do not receive claims discounts for consecutive years of no policy claims, so they are a good indicator of a driver’s driving experience and road safety record.

Chart of cheapest annual car insurance costs by age (Reference 1 at 11,000-12,000 miles).

For most age groups (drivers aged 20-64), the cheapest quotes were received when drivers were estimated to drive between 11,000 and 12,000 miles per year and when drivers were estimated to drive more than 25,000 miles per year The highest price listed is equal to or less than 1,000 miles. It is especially surprising that this effect is also manifested in older drivers, who often have many years of additional driving experience.

Surprisingly, only drivers with the least or most driving experience (17-19 and 65+) saw cheaper offers with lower mileage.

What Are Insurance Groups For Cars? The Full Guide

While the most common mileage deals in our analysis were for 5,000 to 6,000 miles per year, the cheapest deals were for 11,000 to 12,000 miles, with low-mileage drivers paying £232.59 more. Their car insurance.

The cheapest deals are usually for those with an estimated annual mileage of 12,000 miles, which is more than 50% more than the UK average.

The most frequently cited annual mileage was 5,000-6,000 (19%), with the highest number of citations by age group being for drivers aged 30-39 (23% of all citations).

3) The prices listed are the average price of returned cheap car insurance quotes for each age and annual mileage group.

Classic Car Insurance • A-one Insurance Group

Note: In all cases, whether called “average price”, “average quote” or otherwise, the price shown in this report is the average price of the cheapest car insurance quotes returned for that age and annual mileage group.

1) Data based on customer references from 2,466,055 car insurance companies on MoneySuperMarket from 1 July 2018 to 30 September 2018. The prices shown are the average price of returned cheap car insurance quotes for each age and annual mileage group. Source

2) According to the Department for Transport, there were 31.6 million vehicles licensed in the UK as of September 2018. Source

3) 14,503,248 of 8,755,173 cars driven less than 7,134 miles per year (60.4% of all UK cars). According to the latest figures from the Department for Transport, the average number of kilometers driven in the UK in 2017 was 7,134 miles per year. Cars younger than three years old are not included in MOT data. Source

29% Annual Jump In Average Price Paid For Motor Insurance

4) 60.4% of 31.6 million cars is 19.0864 million cars. According to the statistical data analysis above, 19 million drivers are at risk of overpaying on their car insurance. Source

By Miles is a UK startup that offers pay-as-you-go car insurance for people who drive less than 7,000 miles a year. Drivers pay a small upfront payment for an annual policy and then pay based on mileage at the end of each month. This provides many drivers with an opportunity to cut costs if they frequently use their cars for regular short trips or weekends away.

As of 31 January 2019, we have a 9.7 rating on Trustpilot and a top rating of 5 stars from Defaqto. Miles is authorized and regulated by the Financial Management Authority.

MoneySuperMarket is the UK’s leading price comparison website. They provide free online tools to help people manage, save and grow their money, enabling them to compare and switch insurance, money and home services products from over 980 providers across 44 different channels.

Cheap Car Insurance Quotes Online From Right Choice Insurance Brokers

MoneySuperMarket is part of the FTSE 250 listed Moneysupermarket Group PLC. In 2017, they helped around 8 million households save around £2 billion on their household bills, including 5 million saving money on insurance, 2 million getting better finance deals and more than 1 million households to change their lifestyles. vitality. provider

Moneysupermarket.com Limited is an appointed representative of Moneysupermarket.com Financial Group Limited, which offers insurance, mortgage and consumer credit products authorized and regulated by the Financial Conduct Authority (FCA FRN 303190). MoneySuperMarket is accredited for energy products. In accordance with the Ofgem Confidentiality Code. Get a free Morning Headline email with news from journalists around the world Subscribe to our free Morning Headline email Subscribe to our free Morning Headline email

The average cost of car insurance in the UK has hit an all-time high of almost £1,000 after premiums rose by more than 58% in a year, analysis shows.

The cost of car insurance has risen by an average of £338 over the past 12 months, according to the Confused.com price index, which generates more than six million quotes each quarter, according to the comparison website.

Bmw Flex Car Insurance

In August, there were reports that car insurance is fast becoming one of the most expensive household bills, adding to the financial pain at a time of high inflation and rising house prices.

Exclusive data from analysts Consumer Intelligence showed that premiums rose by 48% in the year to June to the highest level since 2018 as thousands of drivers either added extra cover or changed just their first policy.