- Car Insurance By Mileage Malaysia

- Honda Malaysia Upgrades Honda Insurance Plus (hip) Package

- I Beg For A Good Samaritans Help! Car Insurance Wrote Off Car From Scratches!

- 3 Best Ways To Buy A Car: Cash, Hire Purchase & Personal Loan

- Drive Less Save More Insurance

- Official Bmw Malaysia Website

- Volvo Car Insurance Plus

- Promilej Car Insurance: What It Includes And Why You Need It?

Car Insurance By Mileage Malaysia – Our premium estimator provides only estimated costs. Final price may vary depending on purchase details.

We offer various additional benefits to further increase your security. For an additional premium, we cover:

Car Insurance By Mileage Malaysia

Did you know When you choose us, you’ll enjoy more than just protecting yourself and your car!

Honda Malaysia Upgrades Honda Insurance Plus (hip) Package

Get 10% discount when you renew your insurance online. Tired of walking to the counter? Now you can buy insurance through the website or mobile app!

Our trusted online payment partner, iPay88, is regulated by Bank Negara Malaysia and complies with the highest international security standards (PCI DSS 1) and the Financial Services Act 2013.

Promilej offers all the benefits of a comprehensive plan at a lower price. Depending on how far you want to travel, Promilej offers savings to keep you and your wallet safe.

Depending on the Promilej plan you choose, you can save between 10% and 40% of your base premium (including premiums for optional benefits listed above, if applicable).

I Beg For A Good Samaritans Help! Car Insurance Wrote Off Car From Scratches!

You can purchase Promilej by visiting our mobile app (), our website or by calling our call center.

Yes, but you should consider whether it is beneficial based on your current insurer’s short term cancellation rates.

No, before you buy Promilej, you need to submit a photo of your odometer via the mobile app or online. Without this we reserve the right to cancel your policy.

Yes, it is possible. Your consent must be given to us in writing. In the event of cancellation, you will be entitled to a refund of premiums paid based on your traditional short-term premium or minimum premium maintenance.

3 Best Ways To Buy A Car: Cash, Hire Purchase & Personal Loan

Don’t worry if you exceed the given distance. An additional 500 km will be provided before the expiry of the insurance period.

If you exceed both the allotted distance and the additional 500 km, your vehicle will no longer be covered for loss, damage or other optional benefits. However, third party insurance will not be affected.

You must top up your plan before the limit is exceeded. This provides complete protection for you and your vehicle on the road.

You can buy chargers the same way you buy insurance: online, through an app or over the phone. This will be the difference between your current policy and the new policy.

Drive Less Save More Insurance

For example, if your current plan is RM500 and your next plan is RM800, you will only be charged RM300.

If you exceed the allotted mileage before the end of the insurance period, an additional 500 km will be provided.

If you have not yet charged your allocated mileage and sponsored mileage, you will be covered for bodily injury or death of a third party or damage to third party property, not for damage or loss of the vehicle due to accident, fire. or other reasons. Theft (For Promilej policies issued after March 19, 2021, optional benefits listed in 1 above will not be covered if allocated miles and deferred miles are exceeded.)

Once coverage starts, you can pay an additional premium to upgrade to the next available mileage level or get full mileage coverage. A maximum of 2 charges are allowed. If you charge a second time, you can only charge up to full mileage.

Toyota Fortuner (2.7 4×2 Mt) Ownership Cost

No, you cannot rate your plan. You will not be refunded and you will not be able to transfer unused miles to a new plan.

If I buy insurance using the website or app, can I still get the 10% discount?

Your vehicle is not equipped with a device that can track your mileage. When registering for insurance, you only need to submit the mileage of your current vehicles. We will reconfirm your mileage when the claim is made. We also send regular reminders to track your mileage.

You can resend a photo of your binoculars one day before your insurance begins by contacting our staff at 1-800-88-2121. Then we will make the necessary changes.

Usage-based Insurance Is Growing Globally But…

Yes you can buy either a flood cover or a windscreen cover with a premium corresponding to the number of miles allocated.

Please see the Policy Agreement and Product Disclosure Sheet for the full terms of this policy. The benefits paid with the relevant products are protected by PIDM to the maximum extent possible. Please refer to PIDM’s TIPS brochure or contact Insurance (Malaysia) Bhd or PIDM (visit www.pidm.gov.my).

EZ-Mile is an additional car insurance service that offers different mileage plans depending on the conditions of use of the car. This is a supplement to choosing a comprehensive personal car insurance policy.

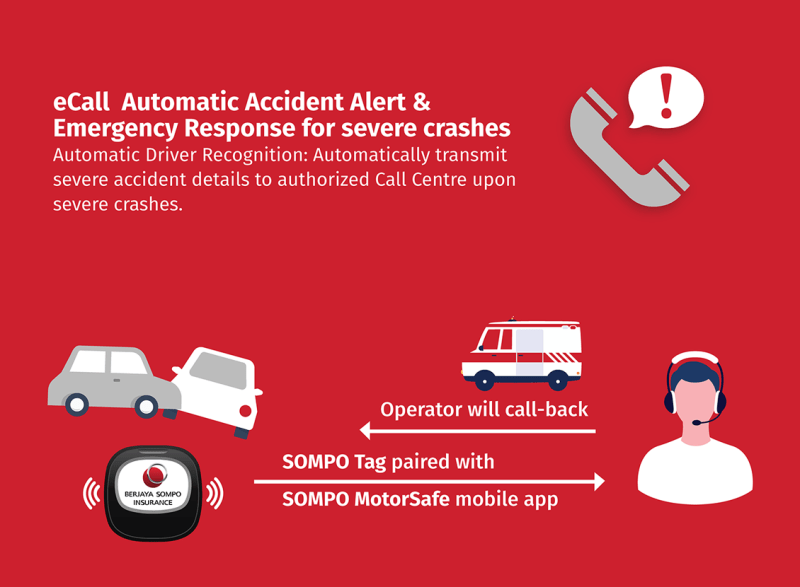

An EZ-Mile policy gives you a micro tag that allows you to connect your smartphone to track mileage, provide useful safety features and call for roadside assistance.

A Step-by-step Guide Buying Car Insurance Online

All taxable general insurance products with policy term beginning on or after March 1, 2024 or policy term ending on March 1, 2024 are subject to 8% service tax (pro rata).

We reserve the right to collect service charge at a reduced rate on insurance products taken out before 1st March 2024, with policy term extending to 1st March 2024.

You are responsible for paying all applicable taxes, including but not limited to service tax and stamp duty, imposed by the Malaysian tax authorities in connection with your insurance.

We update our brochures and product materials to reflect the service charge. The material will be ready on time.

How Do I Cancel My Car/motorcycle Insurance Policy? What Are The Consequences?

Thank you for your interest and for submitting your application. We will review your application and contact you if you are selected for an interview. Pacific & Orient Insurance launches online campaign to promote mileage based packages. May 19, 2021

KUALA LUMPUR: Pacific & Orient Insurance Co Bhd (POI) recently launched an interactive online game ‘Shortcut by Promilej’ to deliver the message to consumers to ‘drive less, pay less’.

Through the campaign, POI seeks to create awareness about Promilej, a usage-based car insurance offered directly to consumers through its website or app.

Breaking the mold of one-size-fits-all car insurance products, Promilej offers flexible personal car insurance at premium rates based on estimated annual mileage.

Official Bmw Malaysia Website

The innovative plan with recharge option currently has three options – at 5,000 km, 10,000 km and below 15,000 km – which will result in savings of up to 40% on comprehensive car insurance premiums.

POI Executive Director Muzeer Qasim said the Traffic Control Order (MCO) due to the Covid-19 pandemic has led to a reduction in vehicle usage as more people limit their travel and work from home.

“With our Promilej product, we give customers the opportunity to choose how much they drive per year and only pay for it.

“However, the product is flexible, as customers can ‘top up’ mileage for additional premiums if they underestimate the required amount.

Volvo Car Insurance Plus

“This ‘top-up’ feature allows consumers to purchase ‘blocks’ of miles when they need them, giving them more control over how much they pay for their car insurance,” Musir said.

The company said participants will stand a chance to win up to RM88,000 in prizes, including the grand prize of a new Proton X50 through the Shortcut Game and Play-to-win campaign.

“We’re excited to release this fun, free game that truly embodies our message. To become a winner, always find the shortest route while driving less!

“As the name suggests, users can win exciting prizes if they reach the shortest route in the fastest time,” Muzir said.

Promilej Car Insurance: What It Includes And Why You Need It?

Points are accumulated throughout the campaign and users are allowed to play daily to increase their chances of winning the weekly prize or the grand prize at the end of the campaign. In today’s world where every ringgit and sen counts, an economical driver is an economical driver. We are always looking for innovative ways to save money without compromising our lifestyle. One area where smart drivers can save significant money is on car insurance premiums. Traditional insurance products often come with fixed premiums, but more and more drivers are choosing pay-per-mile car insurance as a more cost-effective option.

Pay-per-mile insurance, also known as usage-based insurance (UBI), is a relatively new concept that has gained popularity in recent years. Drivers with pay-per-mile insurance pay only for the miles they actually drive, rather than paying a fixed premium based on factors such as age, driving history and location. This means that people who drive less often pay much less for insurance coverage.

For thrifty drivers, the potential cost savings may be the most compelling reason to choose pay-per-mile insurance. By only paying for miles driven, drivers can significantly reduce their insurance costs, especially if they drive infrequently or have short commutes. This approach fits their frugal mindset and allows them to set aside their hard-earned money for other essential expenses or savings goals.

Most economical drivers are environmentally friendly.