Car Insurance Rates – The average monthly premium for a comprehensive insurance policy in the US is $158. Learn about insurance rates in each state, the cheapest vehicles and more.

Written by Maggie O’Neill Maggie O’Neill Maggie has twenty years of experience in the media. He is a writer and editor on insurance and auto related issues. Before joining, he reported on health, education and social issues for blogs, sites and commentaries in Nevada.

Car Insurance Rates

Review by Laura Longero Laura Longero Laura Longero is a strategy and communications manager with over 15 years of experience in media content development, marketing and communications for global brands. He began his career as a reporter and writer and developed his media skills at the USA Today Network, working in various assignments, including managing and writing content for MoneyGeek and XYZ Media.

How Much Is Car Insurance Per Month?

At the time we are mandated to provide consumers with the timely, accurate and knowledgeable information they need to make smart insurance decisions. All content is written and reviewed by industry and insurance experts. Our team carefully reviews rates to ensure we only offer the most reliable and up-to-date insurance policies. We will adhere to the standards of the leader. Our content is based solely on objective research and data collection. We have a strong independent underwriting force to ensure quality insurance coverage.

When budgeting for car insurance, it is important for every driver to understand the monthly cost of car insurance. Auto insurance premiums can vary greatly depending on your location, history, age and type of car you drive.

The average car insurance premium in the US is $158 per month. For the state’s minimum plan, the rate is $42 per month. However, your rate may vary because rates are based on your unique profile. Shop around to find the cheapest deal to save money on car insurance rates.

If you are an accidental driver, you will likely pay lower rates, but the average monthly insurance plan in the US is $158 per month.

Why Michigan Car Insurance Rates Are Skyrocketing: An In-depth Look

The hypothetical driver is a 40-year-old man who commutes twelve miles each day to work, with policy limits of 100/300/50 ($100,000 for personal injury liability, $300,000,000 for total injuries, and $50,000,000 for accidental damages). $500 collision deductible and full coverage.

Prices on vehicles through 2021 include motorist insurance (because some states require it, we do it for everyone) and PIP or medical exemptions, if required by state law. This hypothetical driver has a clean record and good credit.

Liability 100/300 is the same as the molecular amount of the driver, but has a maximum limit of 100/300/50, the motorist and/or less than PIP or MedPay equivalent, if required by the state. We recommend a higher limit, even if you only have insurance. State-defined policies cover only basic state coverage and any other state-required coverage, such as non-motorized or SEED insurance.

The average was calculated using data from the six largest carriers, including Allstate, Farmers, GEICO, Nationwide, Progress and State Firm. Estimated rates for various carrier codes and insurance companies. The median is the object of comparison; Your rate will depend on your personal circumstances.

Remarkable’ Surge In Auto Insurance Costs Fans Us Inflation

An ordinary driver is considered normal risk and should have higher premiums than a preferred or low risk driver. A fast driver takes more risk and pays more in car insurance. Of course, other factors, such as your age, driving history, and zip code also affect your monthly car insurance premium. Please see the table below for maximum and tax-only state rates.

Car insurance rates vary greatly from driver to driver, but where you live also makes a difference. Some states are no-fault and some states are wrong, which affects pricing. Additionally, the minimum state insurance requirements vary from state to state. See the annual and monthly chart below.

Louisiana, Florida and Michigan have been named among the cheapest states in the country for car insurance. Damage from Gulf Coast hurricanes and Midwest hurricanes affects property and casualty and insurance.

Louisiana is the most expensive state with an average monthly rent of $240 per month. Florida is the second most expensive at $224, and California is $201 per month.

Ceic Article: Flooding Aftermath: Brazil’s Insurance Rates Normalize, Moderating Inflation

They are the most expensive vehicles, followed by SUVs, minibuses, hatchbacks, sedans and trucks. The average monthly rental for a van is $150 and the rate rises to $269 per month for a sports car.

Luxury cars/SUVs, performance SUVs, electric vehicles and sports cars are the most expensive. See annual and monthly averages by vehicle type in the table below.

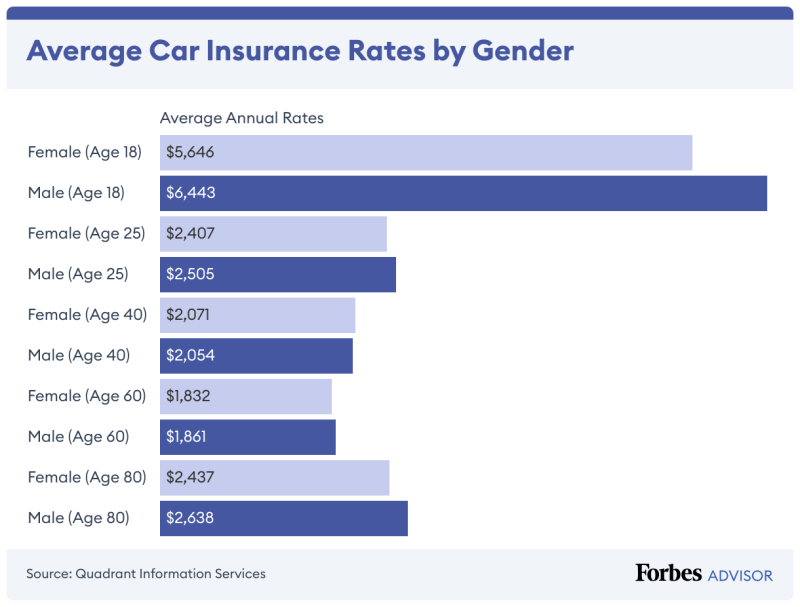

In their teenage years, men will pay $40-$50 more per month for car insurance. However, prices begin to equalize for drivers aged 25 and there is no price difference by gender at age 40.

The reason for the higher price is because young people generally do not have experience with financial compensation products such as insurance.

Average Car Insurance Rates As Of October 2024

James Brau, professor of economics and editor-in-chief of the journal Entrepreneurial magazine at Brigham University Marriott School, says: “In my research on financial literacy among college students, we found that many of them are lacking. of Trade.” This general research can also be extended to understand insurance among college students. Anecdotal evidence from when I teach this topic in classes shows that half of my students do not fully understand car insurance.”

Nevertheless, Dr. Brau points out that being in tune with computers and the Internet can be a way for young people to choose a new way to buy financial things.

“Computer literacy seems to compensate for some of the illiteracy,” he said. “Students are interested in doing Internet research to find insurance products. They can also Google about words and concepts they’ve never been taught.”

Car insurance for 19-year-old males costs $363 per month or $4,360 per year. Car insurance for a 19-year-old girl costs $323 per month or $3,871 per year.

The States With The Most Expensive Car Insurance, Mapped

Car insurance for a 20-year-old male costs $328 per month or $3,935 per year. Car insurance for a woman in her 20s costs $294 per month or $3,527 per year.

If you get a speeding ticket, the average increase in your car insurance is 39% – an average of $751 per year. But these numbers vary greatly from r to r and different conditions.

One way to check your monthly car insurance is to comparison shop. Call your carrier or go online to get a quote from several insurance companies.

You have vehicle and driver information available that you can provide to the insurance company – including the model of your car, how often and how far you usually drive it and what kind of coverage you want.

Ncd, Betterment & Excess Rates In Auto Insurance In Malaysia

Dr. Brau says consumers tend to make more mistakes when buying car insurance. A common mistake, he says, is that they don’t fully understand the minimum state requirements and options that conflict with comprehensive insurance.

“I encourage everyone to use online insurance color and resources to find the best type and limits of their insurance,” he says.

Get quotes from different sources to find the cheapest deals. Ask for discounts to lower your monthly car insurance, such as:

Benefit from shopping around for monthly insurance costs. Some insurance companies will give you better rates than others depending on your personal health.

How Much Does Electric Car Insurance Cost?

USAA, Nationwide and Voyager have the cheapest monthly awards. Note: USAA is only available to military personnel and their families. See the table below for the cheapest national insurances.

You can get the cheapest monthly car insurance. It will depend on your driving history, where you live, required limits, number of previous driving accidents and more.

Car insurance for $150 or less a month as long as you have a good driving record and regular vehicles – stay away from luxury cars and sports cars.

“I don’t believe there is a set average for what a driver should expect to pay for car insurance each month,” says Lauren McKenzie, insurance secretary/agent for A Plus Insurance in Sierra Vista, AZ. “There are many factors such as age, location, race, vehicle information and the option of tax distribution in insurance.

How Credit Scores Impact Auto Insurance Premiums

Buy your policy six months or annually, ask about discounts, and keep a good record and good credit for low auto insurance.

If you get a plan that has a 100/300 in loan payment, then $100 a month in car insurance is a good rate. Of course, the date and age of your car will factor into your monthly car insurance premium, so if you have a recent claim or a new car, you can look for a plan that costs $100 a month.