Buy Third Party Car Insurance Online Malaysia – We are here to protect your vehicle and others in the event of an accident. In addition, you can customize your coverage according to your needs and budget with our affordable add-ons. Save more by paying for what you really need.

This list is not exhaustive. See the motor insurance general agreement for all optional benefits under this policy.

Buy Third Party Car Insurance Online Malaysia

1. According to the laws of the Republic of Singapore, it is an offense to enter the country without extending passenger liability/passenger third-party liability protection to motor insurance.

Tppd (third Party Property Damage) In Insurance Terms Explained

2. You should read and understand the policy and discuss it with an agent or contact the insurance company directly for more information.

3. To expedite service, customers are encouraged to provide complete information required to obtain a copy of a binding/current quote or previous policy/renewal notice.

4. Customers are welcome to visit any GEGM branch or our head office at Menara Great Eastern, Level 18 | 303, Jalan Ampang | 50450 Kuala Lumpur or contact GEGM Customer Service Careline @1300-1300 88/email at [email protected]. They may also refer to agents appointed by GEGM.

5. Please note that our cover/sum assured is based on the market value provided by Insurance Services Malaysia Berhad through the ISM ABI system, which is accepted and applied by tagaful and the insurance industry to determine the market value of the vehicle.

Bank Negara Malaysia On X: “accidents May Happen But Are You Sufficiently Covered? Find Out Which Type Of Motor Insurance Suits You Best. From Third- Party To Comprehensive Plans, Protect Yourself And Stay

1. The above is for general information only. It is not an insurance contract. You can find more detailed insurance conditions on the insurance pages.

2. Great Eastern General Insurance (Malaysia) Berhad 198301007025 (102249-P) is authorized under the Financial Services Act 2013 and regulated by Bank Negara Malaysia. Looking for car insurance? Before purchasing auto insurance, it is best to understand the different types of auto insurance. This ensures that you are adequately insured.

Firstly, there are three types of car insurance available in Malaysia. Let’s take a look at each policy and what it covers.

The first is comprehensive insurance, also called first party insurance. This policy offers the most comprehensive protection to policyholders.

Allianz Third Party Car Insurance

Casco insurance protects the insured’s cars in the event of a traffic accident, fire and theft. This policy also provides third party protection.

Comprehensive insurance is usually mandatory for new cars 10 years old and younger. Most insurance companies recommend TPFT liability, fire and theft insurance for cars over 15 years old, which we explain below.

Third-party fire and theft insurance compensates for damages caused to a third party for which you yourself are to blame. It also covers the policyholders’ vehicles against fire and theft. This policy does not apply to policyholders’ vehicles in other circumstances, such as in the event of a car accident.

This type of insurance is generally cheaper than comprehensive insurance and is more suitable for old and lightly used vehicles.

Mpi Generali Car Insurance 2023: Find Out More!

Third party liability insurance is basic insurance. In Malaysia, motor vehicle owners must obtain at least third party liability insurance in order to legally drive on public roads in Malaysia.

A “third party” in this policy is a person involved in an accident with your car in which you are at fault.

This policy only protects the third party against damage or loss caused by your vehicle to the third party and their property.

This policy provides very limited protection as it can only be used for third party claims. If your car is damaged, you will have to pay for the repairs yourself.

Motor Year End Sales Campaign

For your convenience, below is a summary of the differences between the three types of car insurance:

In order to choose the right car insurance policy, below are three important points to consider.

It is important to choose the right insurance based on the age of your vehicle. This avoids overinsurance (car insurance).

If your car is old, for example more than 15 years old, you should take out liability, fire and theft insurance. This is because the estimated damage costs for your vehicle can be cheaper and more affordable.

8 Best Car Insurance Plans In Singapore To Check Out 2024

On the other hand, if your car is new, we recommend comprehensive insurance that fully covers your car.

If you use your car frequently, we recommend taking out comprehensive car insurance as it can offer more protection.

For example, for a car that is more than 10 years old and is used frequently, comprehensive insurance is a better choice because the insurance provides protection in the event of a car accident.

For vehicles over 10 years old with a market value of more than RM10,000, we strongly recommend taking out comprehensive insurance to ensure your vehicle is properly protected. With comprehensive insurance, you can prevent owners from having to pay large repair costs in the event of a car accident.

Top 10 Add-ons As Chosen By Generali Malaysia’s Car Insurance Customers

Most insurance companies offer the three types of insurance we discussed above. Before purchasing insurance, consider the coverage, the age of your vehicle, the use of the car, and the amount of insurance to ensure adequate coverage.

To compare deals from different insurance companies in Malaysia, just use where you can get up to 15 free car insurance quotes. Compare offers and your new car insurance easily online.

Is one of Malaysia’s largest insurance comparison sites, offering insurance from over 10 brands. Get a free Insurance quote today! Third party car insurance is one of the different types of car insurance offered by insurance companies in Malaysia. As the name suggests, liability insurance only covers third parties who have been involved in accidents caused by the car owner.

Insurance is mandatory for all vehicles on Malaysian roads. Every vehicle must have at least liability insurance in order for the vehicle to be legally used on the road.

Insurance Coverage: 1st Party Vs 3rd Party Insurance

If the car you drive does not have insurance cover, you may face enforcement actions such as fines or a summons from the Royal Malaysian Police (PDRM) or the Ministry of Transport.

Third party car insurance is one of the three types of car insurance offered by insurance companies in Malaysia. The other two types are comprehensive car insurance and third party, fire and theft car insurance.

Basically, third party car insurance covers damages caused by an accident caused by the car owner. This includes compensation for physical damage to the car, bodily injury, medical expenses, vehicle repair costs and third party property damage.

With liability insurance, you cannot claim compensation for damage to your car if you cause an accident. This means that you have to be personally responsible for the damage caused to your car and the insurance only covers the compensation claimed by a third party (the party that caused the accident).

Things To Know About Car Insurance In Singapore

Here are some examples of situations to better understand third party car insurance:

Third-party car insurance is the most affordable insurance coverage and offers basic coverage compared to other car insurances.

In general, the premium price for non-vehicle insurance depends entirely on the insurance company. Car insurance prices depend on the vehicle type, year of manufacture, driving experience and other factors. For example, for a 2005 Myvi car with an NCD level of 55 percent, the minimum premium price is about RM209.

For more information about motor insurance prices, contact your insurance company or visit the website of the best insurance comparison and renewal platform.

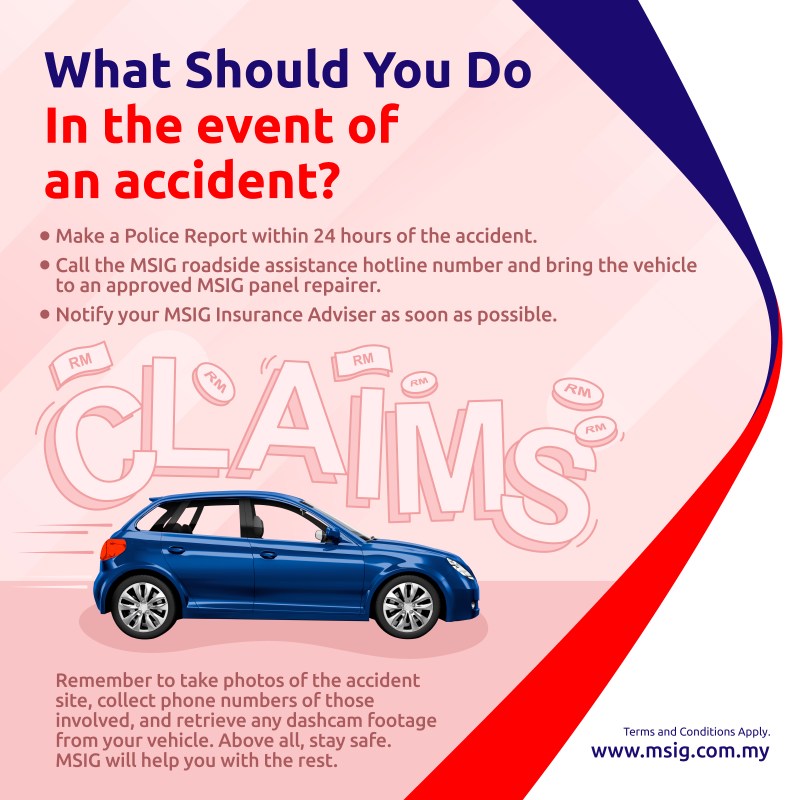

Car Insurance Claims In Malaysia

If there is an accident between your car and a third party, the first step is to obtain the third party’s information, such as name, phone number, license plate and insurance information.

You can then continue processing your third-party car insurance claim by contacting your insurance company. You must provide details of the accident, including:

After making a claim for insurance compensation, the insurance company investigates the accident and, if necessary, compensates the third party. Applying for car insurance is usually faster than car insurance. This is because there are fewer parties, in which case only the claim against the third party is central.

First party car insurance and third party car insurance are two different types of car insurance. First party car insurance (or comprehensive car insurance) offers more comprehensive coverage than third party car insurance.

A Handy Guide: Choosing Car Insurance In Malaysia

In addition to liability protection, auto comprehensive insurance offers the vehicle owner insurance against the risk of loss or damage to the vehicle. First party car insurance also protects the car owner and his vehicle from various risks such as:

At the same time, third-party car insurance offers protection against third-party claims resulting from accidents caused by the car owner. This means that the insurance only covers damages caused to the vehicle by a third party. All the costs of repairing the damage to your car